Table of Contents

Understanding the Significance of Location in Real Estate

Location is a vital factor determining a property's value and potential for future appreciation. Aside from influencing the monetary value of a property it also shapes the long-term satisfaction of a buyer. An ideal real estate investment location ensures access to essential facilities such as schools, hospitals and transport hubs.

Some of the best locations for real estate investment also guarantee privacy and security of investors while ensuring ample growth prospects of the property. Location also plays a huge role in marketability of real estate since a modest home in a prime location can easily outperform a luxury residence in a less popular area.

So to answer why location matters most in real estate, one can simply say while a property can be rebuilt or renovated its location is a non-negotiable asset that cannot be easily changed.

Relation Between Property Value and Location

Real estate property value is closely linked to its location. While it is easy to see how property features like size, design and amenities affect its demand, location plays a major role in determining the property value. Real estate projects strategically located near secure neighbourhoods, major transport hubs and important commercial zones tend to offer long-term investment satisfaction. These properties also appreciate faster than those located in less modest areas. Understanding how to calculate the ROI on a property investment is essential. Thus this heavy influence of location on property value can be summarised as:

Proximity to essential facilities

Properties, especially residential projects located near reputed schools, shopping malls, transport hubs and healthcare centres generally command higher prices. This is because these amenities are crucial for a comfortable lifestyle sought by investors. Aside from these essentials, accessibility to recreational amenities like parks, swimming pools and gymnasiums also enhance the property value.

Growth prospects

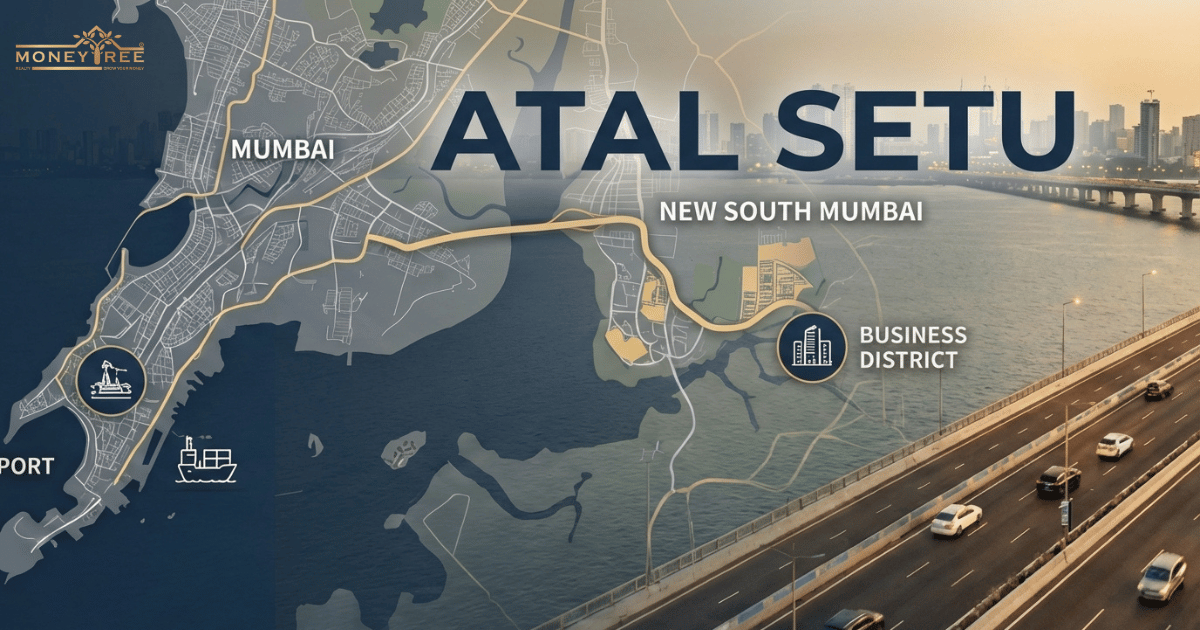

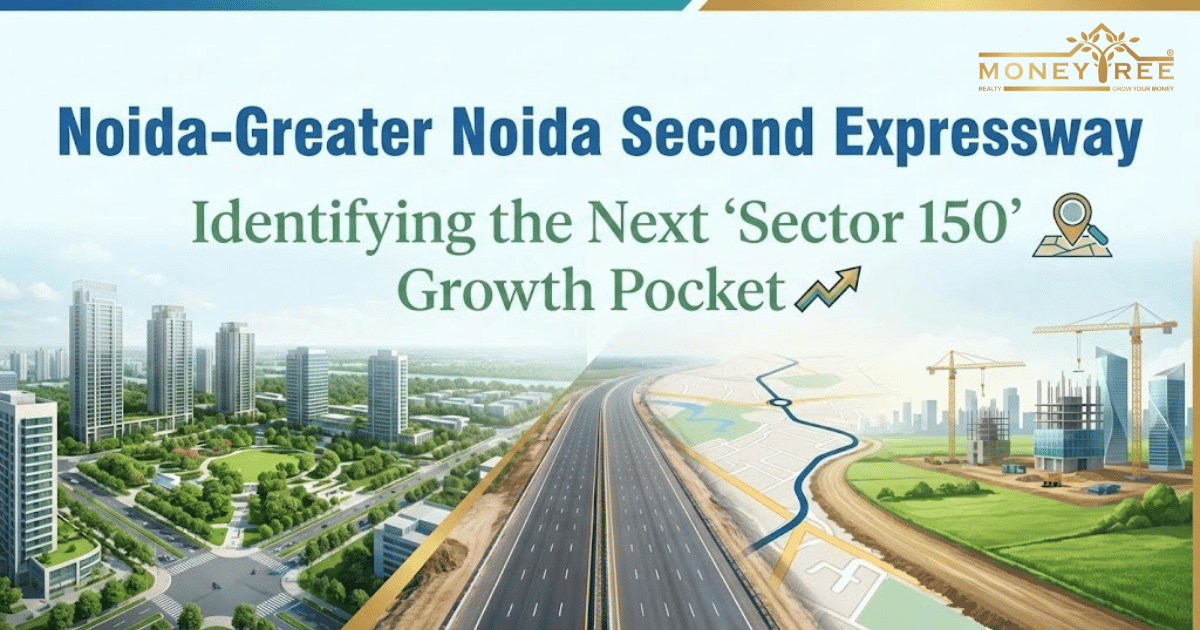

Areas undergoing infrastructural development or economic growth witness rising property values. This is due the region's rising potential to transform into an urban hotspot with easy access to financial hubs of the country. In addition to this, Government policies to introduce metro lines, IT parks and highways can also highly benefit the real estate site and enhance the property value once construction is completed. Learn more about real estate market predictions for 2025.

Secure neighbourhood

Security is one of the key concerns for any investor. Areas with low crime rate, modest level of cleanliness and a harmonious community are considered prime locations for real estate. Since these features top the priority list of most buyers, the property values are also high in these locations. Secure neighbourhoods also foster a diverse community as it attracts people from all walks of life which in the long-run enhances the locality's reputation and investment potential. Read our guide on how to choose the right neighbourhood for your family.

Eco-friendly surroundings

Current global concerns regarding climate change have made most investors conscious about their purchasing habits. Buyers now want to invest in areas surrounded by green spaces and parks to enhance the sustainability of their chosen property. Thus real estate in scenic locations adorned by well-maintained parks and lawns command a high property value.

Some Unconventional Factors Influencing Importance of Location in Real Estate

Real Estate Market Trends by Location in India (2025)

| City/Region | Expected Price Appreciation (2025) | Affordability | Trend in 2025 |

|---|---|---|---|

| Mumbai | 6-7% rise | Improving | Increased demand for luxury projects |

| Delhi NCR | 6-7% rise | Improving | New projects getting launched in luxury as well as affordable sectors |

| Hyderabad | 6-7% rise | Improving | Higher demand for luxury projects |

| Gurgaon | 15-18% in prime areas | Improving | High demand by NRIs/HNI's |

| Kolkata | 5-6% rise | Most Affordable | Steady demand for real estate |

India's major cities are expected to witness a sharp rise in property values in 2025 due to economic growth and infrastructural development in these areas. Gurgaon stands out among all the prime locations with its 15-18% expected price hike in luxury localities while Kolkata remains the most affordable destination among the metro cities.

Pros and Cons of Investing in Urban, Suburban and Rural Projects

| Type of Location | Pros | Cons |

|---|---|---|

| Urban Localities | Easy access to essential amenities like healthcare, education, transport and entertainment. Diverse property offerings and high rental yield. Robust infrastructure and ample employment opportunities. | Expensive property and high cost of living. Lack of green spaces and natural recreational options. High-level of pollution and congestion. |

| Suburban Localities | Affordable and spacious housing options. Safe and well-maintained neighbourhood. Peaceful and slower pace of life than in urban areas. | Limited access to public transportation. Fewer entertainment options as compared to urban areas. Longer commute to employment hubs located mainly in the cities. |

| Rural Localities | Most affordable property options. Peaceful and clean neighbourhood with low levels of pollution. Larger land parcels are available for sale. | Lack of infrastructure and public utilities like healthcare. Less job opportunities available when compared to urban and suburban areas. Lack of renters or tenants. |

Investing in Urban, Suburban and rural areas offers different sets of advantages and challenges. It is difficult to declare one area as the sole profitable real estate destination without accounting for the diverse property needs of investors. Urban areas which are well-equipped with modern infrastructural amenities and state of the art recreational facilities often face high property prices that become unaffordable for many small-scale investors. Similarly suburban areas which are known to offer more affordable and spacious housing options suffer with lack of public transportation. Rural areas on their hand provide larger land parcels and cleaner ambience but might not be ideal for those who have high rental yields. The ultimate choice lies with the investor and their goals and preferences.

Tips on Choosing the Right Property Location

Choosing the right property location is crucial for long-term investment satisfaction and a comfortable lifestyle. While a well-chosen location has the potential to enhance investment profitability, a poorly selected project site can hamper future growth prospects. So here are some property location tips for investors to optimise their investment choices:

Assess the proximity to essential amenities

A region close to essential facilities like a well-equipped healthcare centre, reputed educational institute and transport hotspots offer comfort and convenience to its residents. These are prime locations for real estate since they attract both renters and homeowners. Thus choose cities undergoing infrastructural upgrades, economic growth and social development like Mumbai, Gurgaon and Delhi.

Evaluate the security of the location

Ensure that the locality of your chosen project is safe, clean and well-maintained. Security is the most crucial aspect of high-value properties thus prioritising localities with low crime rates. A dynamic and vibrant community improves both lifestyle and property value.

Study the rental vacancy rates

A strong rental demand would reflect in a low vacancy rate. This ensures steady income if investors plan to rent out their property. A vacancy rate of 2-3% is generally considered the benchmark for high rental demand and thus indicates a high return on investment.

Investigate employment opportunities and development prospects

While choosing a real estate investment location check whether it is close to any employment hotspot or commercial zone. A real estate site close to any business centre or IT park offers better rental yield and price appreciation opportunities. An investor can also choose a location that shows potential for future growth and development but they need to be careful of any nearby project that can negatively impact property value.

How to Conduct Proper Location Analysis in Real Estate

By now we understand how location affects home buying decisions but it is also important to know how to properly analyse a real estate site to get the optimal benefits. So here are some things to keep in mind while selecting a real estate site: